Commercial Real Estate Market Statistics: A Summary of 2016 and a Look Toward 2017

2016 was a hot market year for Commercial Real Estate. Thousands of new jobs were created that are having a dynamic impact on our industry and consumer spending continues to rise.

2017 is looking bright as we head into the New Year, and we are excited to see continued growth from business investments, exports, reconstruction and supply chains.

Here’s a brief look back into 2016 and a projection of what’s to come in 2017.

2016

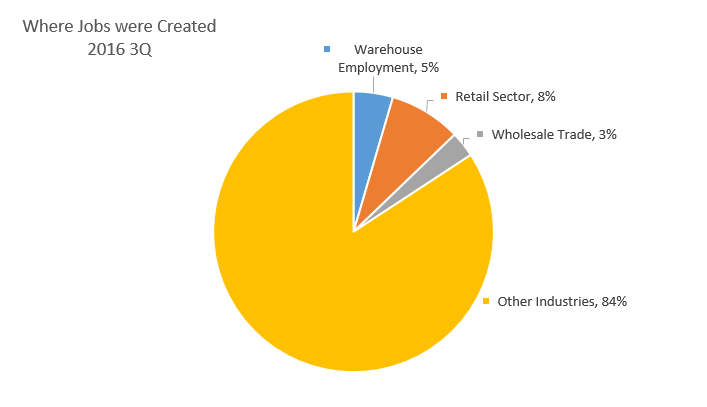

- Third quarter results show that personal consumer spending rose at an annual rate of 2.1 percent. Most of the spending was on goods and services.

- Export activity increased, which means that companies are coming closer to their goal of serving global markets.

- Business investments are up by 5.4 percent. Owners are interested in growing their businesses and are willing to take more monetary risks right now.

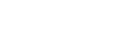

- 619,000 jobs were created. Of those, 28,100 were in warehouse employment. The retail sector added 51,200 jobs and the wholesale trade industry gained 18,300 jobs.

- Demand for industrial properties rose, while older properties such as malls and community centers often remained empty.

- Office and retail space building and leasing remain stagnant as business owners are turning their attention to industrial space.

2017

- The national unemployment rate is under 5 percent. This will allow companies to be more profitable since they have enough workers to commit to their production lines and run their office operations. Low unemployment rates also benefit every other industry because these individuals will keep buying goods and services, in turn, balancing out the old economic scale of supply versus demand.

- There will be a small increase in the need for apartments and senior housing as millennials and baby boomers seek to settle into properties that are not single family dwellings.

- An increase in the need for retail and office space is expected, as business owners take more risks and add products and services to their offerings.

- Investor spending by business owners located outside of the U.S. is expected to increase due to the low lending rates and new opportunities afforded them in this country.

- Old malls and dated commercial properties will be re-purposed, turning into classrooms, last mile supply warehouses, expanding city government offices, and possibly new places for entertainment such as kid’s play zones, bowling alleys, and other family-oriented entertainment centers.

- Lower energy prices will continue to be a factor as companies are able to spend less on operations and more on bringing products and services into an area.

Although 2017 seems brighter, there is still work to be done in each community in order to fully restore economic prosperity. Gaughan Companies is excited for these new opportunities, and we look forward to working with you to meet all of your commercial real estate needs.

-Patrick Gaughan

The Commercial Construction Process – Part Three

This concludes the series on the commercial construction process. When we left off a few weeks ago, the HVAC, plumbing, electrical systems, drywall and doors had all been completed. (You can read part one here and part two here.) Now let’s turn our attention to finishing up and moving in.

After the building’s main systems have been installed, it’s time for the cosmetic details to be applied. Flooring, painting, light fixtures, plumbing fixtures, door hardware, electrical device covers, trim and cabinets are installed as the last step of the building process.

Landscaping and final site improvements are completed. HVAC, electric and water systems are turned on. All required inspections are completed to assure that construction has been performed in accordance with the plans and specifications and that the building is safe to occupy. Once all inspections have been satisfactorily completed, a Certificate of Occupancy is granted deeming the building safe to begin business.

As the building was being built, it was inspected by professionals at every step of the process. After the final inspections, most general contractors will call a meeting with their team to discuss how the project went. This provides them a chance to discuss any problems that may have occurred along the way and develop a plan for their next project. It’s also a good time to review the budget and verify that everything has been completed as budgeted.

As the contractors walk through the building, they create a punch list of any items that need immediate repair. These normally relate to defects in finishes and typically include repairing nicks in walls, repairing a crack in the floor, or changing light fixtures.

If a formal closing has not already been established by the lender, the building owner will need to complete this step before anything else can be done.

Lastly, if not already on site, curtains, blinds, cabinets, furniture, office equipment, desks, chairs, phone lines and appliances (such as microwaves and refrigerators for breakrooms) will be installed.

Depending on the size and planned use of the new building, the business owner may arrange for the press to come out for a grand opening. Often, a ribbon cutting ceremony is accompanied by a festival-like atmosphere as employees and members of the community are brought in to tour the building. A start date for operations is determined and staff are given a report date. Generally, within a few days or weeks of taking occupancy of the building, the business is ready to open its doors, and the process is complete.

-Dan Hebert

Trends that will Drive Investment and Development in 2017

2017 is just around the corner, and Americans are pondering what their day-to-day lives will look like in the coming year. Technology is advancing rapidly, and several things exist today that our grandparents would never have deemed possible.

The leader of the pack is the internet. As more and more devices become smart-wired and connectable to the internet, new ideas and services are becoming a reality.

Large metropolitan cities and high rise buildings are now able to use the internet to monitor and control things such as traffic flow, water resources and energy allotment. This helps conserve valuable resources and enables them to operate more cost-efficiently.

Consumers can now purchase electric crock pots that will warm dinner at the touch of a button, from miles away. They can log on to a website and view their child or pet in a daycare setting. They can also set their home’s security system and view their property from a camera lens while sitting in their office desk.

Commercial real estate developers and brokers are getting involved in this trend by using 3-D tours of homes to show buyers and potential customers “actual” and “what if” scenarios. Savvy business owners are capitalizing on the success of popular online games and are creating “lures” so that perspective customers are drawn to their spot.

City governments are teaming up with commercial real estate developers to revitalize the downtown areas in many major U.S. cities. Live, work and play communities are making it easier for the average worker to be able to take care of all of his or her needs without driving a car or getting caught in commuter traffic.

For those companies that still want to operate in major U.S. cities, it’s not uncommon for them to get subtenants who don’t compete with them. These subtenants may rent out other units or floors in a building owned by a major business.

Commercial real estate companies are finding it harder to get financing as the larger banks crack down on their lending policies. As a result, many are calling on local or regional banks to ask for financing.

Since these smaller credit unions and banks already have an interest in seeing their own businesses thrive in a slow development season, they are usually more than happy to finance the loan. This becomes a win-win situation for both them and their borrowers.

As baby boomers retire and move out of the workforce, they are seeking affordable housing. This trend is shared with millennials who no longer see their first job as being a permanent career. Both segments of the population want to be free to travel and to pursue a lifestyle that fits their whim.

More baby boomers are retiring than new income earners are entering the workforce. This is creating a labor shortage in several industries, especially among blue collar workers. In addition, some people are extending their college years, putting off a formal entrance into the labor force until they have achieved a higher education degree.

The millennials are also more hesitant to put down roots. However, the retirees may be selling that large home where they raised their family in favor of a trendier and smaller living space. Both generations are happy to use public transportation when it’s easy to access and when they are made to feel safe and secure.

Another trend on the rise is online shopping. Companies are trying to beat each other to the punch by offering same or next day delivery. In order to accomplish that task, they need to have a lot of warehouse space available and keep it supplied with the hottest items.

Proximity to the customer remains an issue. As the New Year approaches, many companies are eyeing abandoned super stores and malls and turning them into “last mile” distribution centers. Old fashioned rail cars, shipping containers and delivery trucks are still on the main supply chain. However, everyone is waiting to see if “drone delivery” will really be implemented.

More and more Americans are moving to the suburbs, which is another reason why city governments are fighting to revitalize their downtown communities. Businesses are also continuing to move some of their main offices to the suburbs, citing lower rents and more space available for the money as incentives.

Once these consumers and businesses head for the suburbs, the single home and new apartment industries benefit, because everyone needs a place to live. New home prices are rising by about five percent a year, but the new job creation rate is only growing by about 1.7 percent per year.

As more and more of the general population moves to the suburbs, the need increases for medical offices, restaurants, shopping, specialty stores, entertainment plazas, religious services, parks and grocery stores. This, in turn, benefits the commercial real estate industry by creating a demand for their services.

There are many new and exciting changes in store for 2017. Education will continue to be very important, and older workers will need to embrace added career training in order to stay ahead in a changing work environment. Business developers will need to build smarter, more durable structures and operate them more efficiently. City governments need to work together to create safe communities in order for their areas to succeed.

Technology will continue to lead the pack. Americans will continue to compete for business on a global scale. The best way to succeed in this changing world will be for the average business to operate smart, lean and with good conscious.

-Patrick Gaughan

The Commercial Construction Process – Part Two

When we left off with part one of the commercial construction process, we were discussing how an architect develops plans and specifications that a contractor uses to bid the project. (As a side-note, a contractor can use the plans and specifications to assist with a remodel, too, but for the purposes of this blog, we are only discussing new construction.)

It is good practice to solicit bids from at least three general contractors and then determine which one will be the best fit to work on the project. The contractor needs to view a list of building materials. This is usually provided in the plans and specifications. A determination can then be made on material and labor costs.

Once a general contractor is selected, that person will often bring his or her own sub-contractor team in to consult on the project. Several items will have to be installed in the new building, including HVAC, electric wiring, mechanical devices, utilities and plumbing. The contractor will apply for a building permit at the city. Once the city approves the building permit and the fees are paid, work can begin.

The first step in putting up the building is to break ground. Many new owners love to bring their personal shovel in to get a picture made of themselves scooping up the first pile of dirt for their new business address. After the festivities have commenced, they step aside and excavation begins.

During the excavation process, the soil is removed and/or compacted to assure a suitable base for the building foundation. Rocks, tree roots, glass, debris and the like are removed during this period.

Next, if any pipes need to be installed under the building for sewer and water, this needs to be done before the foundation is constructed. No work can be performed until this occurs. After that, construction of the foundation usually consists of pouring concrete within forms prepared by the contractor.

After the concrete foundation has cured, the initial framework can begin. During this time, the contractor will construct the exterior walls and roof. Once the building shell is completed, interior can begin. At this time, insulation, interior walls, drywall, doors, HVAC, electrical, plumbing are all completed.

Look for part three of our series to continue in a few weeks.

-Dan Hebert

Why Manufacturing Growth Affects Everyone

According to studies compiled by Markit Economics, U.S. manufacturing is down for the months of August and September. The recent news of Brexit and the fact that China has reached a slump in their economy is causing slower manufacturing and spending around the world. The U.S. is only at a two percent growth rate for the year.

Minimum wage earnings are down for Americans compared with where they were about fifteen years ago, and the hiring trends by companies have also slowed. If Americans can’t spend, the economy can’t grow.

Economists have estimated that the average age that it takes to double the standard of living for the average American is now up to about seventy years. This inability to change one’s circumstances within a short amount of time has led to the baby boomers not having enough to retire on, so a lot of them go back to work. However, due to their age, they are usually stuck in dead end jobs that pay very little.

Young people who would ordinarily be graduating college, then landing that first job, buying that first home, and starting their family, are now moving back into their parents’ basements in droves. If they are lucky enough to land a great job, they are not getting great offers that the grads of twenty years ago did. In addition, the Federal Reserve is starting to increase interest rates, which makes it harder to purchase homes and automobiles.

There are several things in development here in the U.S. that are also causing our economy to be sluggish in growth. It doesn’t help that the unrest and attacks overseas have caused Americans to think twice or pause for longer periods of time before booking long awaited vacations to foreign countries. So the travel and tourism industries are suffering. In turn, those countries that might ordinarily have great products or services to export, may be suffering from a lack of workers and facilities because of war and civil unrest.

It also doesn’t help that we are all waiting on the results of the Presidential Election. The fiscal policies, public investment and structural reform that the new President will put into place will greatly affect our economy and cause ripple effects around the world.

The U.S. manufacturing companies are watching all of this unfold around them. With the advancement of the ease of deliveries, many Americans are using their purchasing power to order from overseas companies who are marketing cheap products and sometimes lesser quality to Americans who want to get the most for their dollar.

This in turn affects local suppliers who have slowed in their production times because the orders are not coming in. Many of them prefer to make items in bulk quantities, so they are hesitant to fire up the assembly lines and employ workers who many not have much to work on. The U.S. manufacturers are also hesitant to have a lot of inventory laying around, especially those who work in food services, because they know there is a shelf life to their product. They don’t want to have it still sitting in their warehouse when it’s close to expiration.

The U.S. dollar is strong right now too, and even though some countries are catering to Americans, others can’t afford to. This lessens the global demand for U.S. goods and services. However, it is estimated that nearly half of all U.S exports go to countries that we have free trade agreements with. Also, when the U.S. plants do fire up their assembly lines, it is estimated that they use about thirty percent of the nation’s energy supply in order to run their operation. So, that is good for the energy industry.

No one knows what the answer is to get the world economy moving again. Several theories have been tried and discarded. The only thing that seems to make sense is for industry leaders to invest in better training for their employees, study the competition abroad, increase funding for STEM related fields, and find ways to make great products at affordable prices.

Top Ten Commercial Real Estate Trends

2016 is showing great promise in both updating commercial real estate trends, and adding new ones. The following are things to watch for this year:

1. Overseas Investment into U.S. Commercial Real Estate

The U.S. property market is among the most stable and transparent in the world. With growth slowing in Europe and China, foreign investors are flocking to back U.S. projects. According to the Commercial Real Estate Development Association, $91.1 billion was spent by overseas investors on U.S. transactions in 2015. That accounts for 17 percent of all deals. Most of the investors are from Canada. Since that country is lacking in dense populations and has limited resource investment, their citizens’ view the U.S. as a lucrative way to leverage their buying power.

2. Global Urbanization and Its Reverse

Millennials and Baby Boomers have something in common. They both want to seek out living space in metro areas. As they move away from the suburbs, they are looking for affordable units to rent or purchase. In addition, they need to find places to buy their groceries, get some exercise, and shop for household items and apparel.

Generation X and Millennials with children, however, are either staying in or moving to the suburbs. Promises of more house for the money, large green lawns and local parks and playgrounds are drawing them out. Once they relocate to the suburbs, they also need to get groceries, find places to exercise, and shop for household items and apparel.

Commercial real estate has an edge in both urban and suburban areas as builders try to meet the demands of bringing grocery stores, parks, gyms, recreation sites, and houses of worship, coffee shops, bookstores, and more to the market.

3. New Commercial Construction will be More Limited

Building new multi-family dwellings is diminishing. However, the need for senior and student housing is increasing. As these demographics look for affordable housing, they are considering new options such as the tiny house movement. In addition, cities are taking old abandoned big box stores and malls and are re-purposing them for uses that better fit this day and age. Gyms, recreation facilities, and even government offices now sit where old eyesores used to reside. The city leaders realize that often it’s much more cost-effective to remodel an existing structure, rather than invest in new construction.

4. Tearing Down Parking Lots and Garages

As metro consumers get used to using mass transit, more and more of them are ditching their autos and relying on goods and services that can be obtained through delivery or by walking directly to the retailers. They seek communities that are made up of mixed use dwellings, such as having a retailer on the bottom floor, and housing on the top floors. In addition, green space has become very important for city dwellers. They want a place to play with their kids, walk the dog, bicycle and roller skate. Since land space is limited, parking lots and garages are often torn down in order to make room for more buildings.

5. Increasing Stress on Retailers

The average consumer is having to pay more these days to use their credit card, and merchant processing fees are higher too. Reports suggest that on-line sales have triumphed over in-person sales, especially around Thanksgiving weekend. In order to combat this trend, retailers will have to create virtual shopping that combines with physical shopping. Major retailers are already being threatened by discount stores that carry quality, off-brand merchandise. Almost monthly, we hear about large companies such as Macy’s, K-Mart, and JC Penney that are closing stores. However, it seems that chain restaurants are expanding. Commercial real estate experts need to move quickly to fill those properties that have been abandoned.

6. Rising Interest Rates

If the Federal Reserve continues to raise the interest rates, the market will become more stable. However, it will also rule out the small business person who has dreamed of opening a small brick and mortar store. According to the Small Business Administration, small business owners own or lease between 30 and 50 percent of all commercial real estate space in the U.S. However, if these entrepreneurs and franchises can’t afford the rent, these properties will remain vacant.

7. Drop in Energy Prices

The price of oil has dropped several times this year. This draws consumers out of their homes, and encourages them to travel. Hotels, restaurants, attractions and city tourism benefit because they are hosting more guests. As for running businesses, consumers are seeing more profit in part, because their heating and air conditioning bills are dropping. This gives additional buying power, and they tend to want to go out to enjoy their surroundings more. This affects commercial real estate experts because they need to be sensitive to those establishments that are ready to add on to their existing properties.

8. Changes in Office Landscape

Americans are seeing change come to their workplace. Several companies support telecommuting. Others support desk-sharing. It seems that the bigger companies such as AT&T are doing away with the cubicles of yesterday, and are instead embracing a collaborative work space environment. Huddle rooms, quad shaped desk rounds that hold 4-5 workers, and a lack of dividing walls and walkways have become the norm. Commercial developers are watching this new trend, and need to be quick to respond with proposals for interior remodeling.

9. The Introduction of LEED

Along with the new trends in the workplace environment, companies are embracing “going green.” They are installing energy efficient thermostats, and water savings devices that will cut down on their carbon footprint. They are also trying to continue to go paperless and rely on a digital environment.

LEED stands for Leadership in Energy and Environmental Design. It uses 3rd party verification to verify that a building is “green.” In addition, companies are installing green space inside of buildings, and planting vegetation. Commercial real estate companies need to understand this trend and be ready to respond with sub-contractors that are knowledgeable in these fields.

10. The Advancement of the Internet of Things

Pretty soon, getting to the office, turning on the lights and heating up the coffee maker will be things of the past. With the internet of things, more and more “smart buildings” are being created. Special wiring will interface with digital technology to make the life of the consumer even easier. A worker will be able to turn on the lights in the office, start the coffee maker, and pan the security cameras from the comfort of his home. If he does decide to go into the office, he can remote in to his kid’s daycare, start the oven or the crock-pot at his home, and start his car, all from the touch of button.

As commercial real estate companies continue to study this trend, they need to be able to respond by having sub-contractors who are well versed in creating apps that allow building managers to remotely control the building resources and respond to requests to restock or send janitorial services on demand.

The world and its resources are changing around us every day. We, as commercial real estate industry professionals, along with our partners, are developing plans to meet and stay ahead of these trends and demands. We aspire to be the new leaders on the information superhighway and community advancements of tomorrow.