Understanding the Basics of 1031 Exchanges

When a business owner or investor sells a piece of property, the taxes on that sale can be significant. Using a 1031 exchange can help you defer tax payments, under qualifying circumstances. Here, we will explain how this process works and help you understand the basics of 1031 exchanges.

WHAT IT IS

The 1031 exchange gets its name from Internal Revenue Code Section 1031. Under this law, a taxpayer can postpone taxes from the sale of an investment or business property by reinvesting those earnings into another property or properties of equal or greater value to the one sold.

Some of the most common properties exchanged include:

• Apartment buildings

• Retail shopping outlets

• Office buildings

• Duplexes and triplexes

• Industrial buildings

Exchanges once were allowed for any type of investment property, including vehicles, collectibles, equipment, and even patents. Because of changes made by the Tax Cuts and Jobs Act of 2017, exchanges of personal property and intangible business resources are no longer permitted.

IRS GUIDELINES

To qualify as a 1031 tax-deferred exchange, the IRS has a list of rigorous guidelines that must be followed.

• Relinquished property (any property being sold) and replacement property (the property being acquired) must be real estate, or “like-kind” assets. But exchange properties can be of different types, i.e. a duplex seller can buy a retail property, or a land seller can buy an apartment building.

• Replacement property should be of equal or greater value, though that value can be spread across several properties. If replacement property is of lower value, you will be taxed on the difference.

• The most common type of property ID is the Three Property rule. Here the property seller can identify up to three replacement properties within a 45-day window, which includes weekends and holidays. This timeline is activated as soon as your relinquished property sale closing occurs.

• Any replacement property or properties must be fully purchased within 180 days of the relinquished property’s sale. This includes an official transfer of ownership title.

• You are prohibited from holding any money from the sale of the relinquished property you want to exchange. A qualified intermediary, or accommodator, is required to hold onto your money until the new property is purchased.

Failure to follow these regulations will repudiate the 1031 exchange provision, resulting in tax impositions.

BENEFITS

The most obvious benefit of a 1031 exchange is the capital gains tax deferment. By delaying (or ultimately eliminating) the tax burden, you will have more money available for your next investment or investments.

Additionally, a 1031 exchange can be reapplied any time you sell a property. This allows you to increasingly trade into investment properties and significantly grow your net worth.

LET OUR EXPERTS GUIDE YOU

If you have questions about whether this tax strategy can work for your investments, contact us. Tom Opsahl or John Chirhart from our team of real estate brokerage experts can help you navigate the details to ensure you understand the basics of 1031 exchanges.

Employee Education Returns Employee and Customer Reward

At Gaughan, we prioritize in empowering our employees through educational opportunities for their personal and professional growth, which results in our company being able to better serve our customers.

Recently, Rozeanna Berg our Director of Commercial Accounts & Facility Services attended a week long ASM track consisting of Financial Analysis courses, where you learn about the importance of Asset Management and Loan Analysis.

Certified Property Manager (CPM)

The Certified Property Manager (CPM) designation, administered by the Institute of Real Estate Management (IREM), is a professional real estate designation recognized by the National Association of Realtors (NAR). The course schedule for this designation:

- Ethics for the Real Estate Manager

- Budgeting, Cash Flow, and Reporting for Investment Real Estate

- Marketing and Leasing Strategies for retail, multifamily or office buildings

- Leading a Winning Property Management Team

- Managing Maintenance Operations and Property Risk

- Financing and Loan Analysis for Investment Real Estate

- Performance and Valuation of Investment Real Estate

- Asset Analysis of Investment Real Estate

Due to the difficulty of the course load, studying to become a CPM has its challenges. However, the information and knowledge gained from the courses sets you apart from other professionals in the industry.

Rozeanna’s dedication to providing stellar service to our customers, inspired her to enroll in the fast track curriculum to obtain her CPM. She has already completed 9/10 courses necessary for this achievement and has began passing on the educational value to the clients we serve. We will track her progress along the way to reaching this goal.

In addition to Rozeanna being on the cusp of obtaining her CPM, Kelley Lemon, our Director of Multifamily & Facility Services and our Senior Residential Property Manager, MJ Fleming, have just obtained their Multifamily Housing Manager (MHM) designation administered by Quadel.

Multifamily Housing Manager (MHM)

The MHM certification provides staff with the knowledge and skills needed to ensure your multifamily housing properties are in regulatory and occupancy compliance with all HUD program requirements.

Our Multifamily Management team manages a significant portfolio of Class A to C Market Rate and Subsidized assets in the Twin Cities market.

Contact us to inquire about how our Management and Facility Services can provide for your Office, Retail, Industrial or Multifamily investments.

Liffey on Snelling: Vital Component in Economic Development

Liffey on Snelling

Major developments are in the forecast for St. Paul’s Snelling Avenue. Excitement has sprung across the Midway neighborhood and not only because of the new Allianz Field. Gaughan’s very own Liffey on Snelling has been generating quite a bit of buzz. Finance & Commerce recently published an article featuring Gaughan’s Senior Vice President Dan Hebert, articulating the communities interest in redevelopment. You can read the article here.

Likewise, the Pioneer Press also released an article mentioning the development of Liffey on Snelling. Check that article out here.

Commercial Real Estate Market Statistics: A Summary of 2016 and a Look Toward 2017

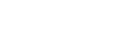

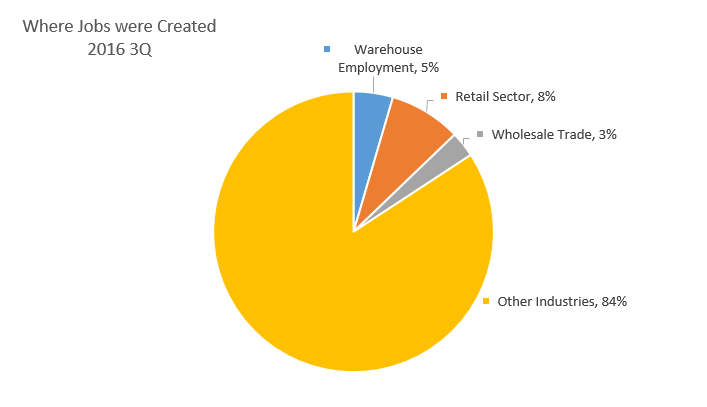

2016 was a hot market year for Commercial Real Estate. Thousands of new jobs were created that are having a dynamic impact on our industry and consumer spending continues to rise.

2017 is looking bright as we head into the New Year, and we are excited to see continued growth from business investments, exports, reconstruction and supply chains.

Here’s a brief look back into 2016 and a projection of what’s to come in 2017.

2016

- Third quarter results show that personal consumer spending rose at an annual rate of 2.1 percent. Most of the spending was on goods and services.

- Export activity increased, which means that companies are coming closer to their goal of serving global markets.

- Business investments are up by 5.4 percent. Owners are interested in growing their businesses and are willing to take more monetary risks right now.

- 619,000 jobs were created. Of those, 28,100 were in warehouse employment. The retail sector added 51,200 jobs and the wholesale trade industry gained 18,300 jobs.

- Demand for industrial properties rose, while older properties such as malls and community centers often remained empty.

- Office and retail space building and leasing remain stagnant as business owners are turning their attention to industrial space.

2017

- The national unemployment rate is under 5 percent. This will allow companies to be more profitable since they have enough workers to commit to their production lines and run their office operations. Low unemployment rates also benefit every other industry because these individuals will keep buying goods and services, in turn, balancing out the old economic scale of supply versus demand.

- There will be a small increase in the need for apartments and senior housing as millennials and baby boomers seek to settle into properties that are not single family dwellings.

- An increase in the need for retail and office space is expected, as business owners take more risks and add products and services to their offerings.

- Investor spending by business owners located outside of the U.S. is expected to increase due to the low lending rates and new opportunities afforded them in this country.

- Old malls and dated commercial properties will be re-purposed, turning into classrooms, last mile supply warehouses, expanding city government offices, and possibly new places for entertainment such as kid’s play zones, bowling alleys, and other family-oriented entertainment centers.

- Lower energy prices will continue to be a factor as companies are able to spend less on operations and more on bringing products and services into an area.

Although 2017 seems brighter, there is still work to be done in each community in order to fully restore economic prosperity. Gaughan Companies is excited for these new opportunities, and we look forward to working with you to meet all of your commercial real estate needs.

-Patrick Gaughan

Trends that will Drive Investment and Development in 2017

2017 is just around the corner, and Americans are pondering what their day-to-day lives will look like in the coming year. Technology is advancing rapidly, and several things exist today that our grandparents would never have deemed possible.

The leader of the pack is the internet. As more and more devices become smart-wired and connectable to the internet, new ideas and services are becoming a reality.

Large metropolitan cities and high rise buildings are now able to use the internet to monitor and control things such as traffic flow, water resources and energy allotment. This helps conserve valuable resources and enables them to operate more cost-efficiently.

Consumers can now purchase electric crock pots that will warm dinner at the touch of a button, from miles away. They can log on to a website and view their child or pet in a daycare setting. They can also set their home’s security system and view their property from a camera lens while sitting in their office desk.

Commercial real estate developers and brokers are getting involved in this trend by using 3-D tours of homes to show buyers and potential customers “actual” and “what if” scenarios. Savvy business owners are capitalizing on the success of popular online games and are creating “lures” so that perspective customers are drawn to their spot.

City governments are teaming up with commercial real estate developers to revitalize the downtown areas in many major U.S. cities. Live, work and play communities are making it easier for the average worker to be able to take care of all of his or her needs without driving a car or getting caught in commuter traffic.

For those companies that still want to operate in major U.S. cities, it’s not uncommon for them to get subtenants who don’t compete with them. These subtenants may rent out other units or floors in a building owned by a major business.

Commercial real estate companies are finding it harder to get financing as the larger banks crack down on their lending policies. As a result, many are calling on local or regional banks to ask for financing.

Since these smaller credit unions and banks already have an interest in seeing their own businesses thrive in a slow development season, they are usually more than happy to finance the loan. This becomes a win-win situation for both them and their borrowers.

As baby boomers retire and move out of the workforce, they are seeking affordable housing. This trend is shared with millennials who no longer see their first job as being a permanent career. Both segments of the population want to be free to travel and to pursue a lifestyle that fits their whim.

More baby boomers are retiring than new income earners are entering the workforce. This is creating a labor shortage in several industries, especially among blue collar workers. In addition, some people are extending their college years, putting off a formal entrance into the labor force until they have achieved a higher education degree.

The millennials are also more hesitant to put down roots. However, the retirees may be selling that large home where they raised their family in favor of a trendier and smaller living space. Both generations are happy to use public transportation when it’s easy to access and when they are made to feel safe and secure.

Another trend on the rise is online shopping. Companies are trying to beat each other to the punch by offering same or next day delivery. In order to accomplish that task, they need to have a lot of warehouse space available and keep it supplied with the hottest items.

Proximity to the customer remains an issue. As the New Year approaches, many companies are eyeing abandoned super stores and malls and turning them into “last mile” distribution centers. Old fashioned rail cars, shipping containers and delivery trucks are still on the main supply chain. However, everyone is waiting to see if “drone delivery” will really be implemented.

More and more Americans are moving to the suburbs, which is another reason why city governments are fighting to revitalize their downtown communities. Businesses are also continuing to move some of their main offices to the suburbs, citing lower rents and more space available for the money as incentives.

Once these consumers and businesses head for the suburbs, the single home and new apartment industries benefit, because everyone needs a place to live. New home prices are rising by about five percent a year, but the new job creation rate is only growing by about 1.7 percent per year.

As more and more of the general population moves to the suburbs, the need increases for medical offices, restaurants, shopping, specialty stores, entertainment plazas, religious services, parks and grocery stores. This, in turn, benefits the commercial real estate industry by creating a demand for their services.

There are many new and exciting changes in store for 2017. Education will continue to be very important, and older workers will need to embrace added career training in order to stay ahead in a changing work environment. Business developers will need to build smarter, more durable structures and operate them more efficiently. City governments need to work together to create safe communities in order for their areas to succeed.

Technology will continue to lead the pack. Americans will continue to compete for business on a global scale. The best way to succeed in this changing world will be for the average business to operate smart, lean and with good conscious.

-Patrick Gaughan

The Commercial Construction Process – Part Two

When we left off with part one of the commercial construction process, we were discussing how an architect develops plans and specifications that a contractor uses to bid the project. (As a side-note, a contractor can use the plans and specifications to assist with a remodel, too, but for the purposes of this blog, we are only discussing new construction.)

It is good practice to solicit bids from at least three general contractors and then determine which one will be the best fit to work on the project. The contractor needs to view a list of building materials. This is usually provided in the plans and specifications. A determination can then be made on material and labor costs.

Once a general contractor is selected, that person will often bring his or her own sub-contractor team in to consult on the project. Several items will have to be installed in the new building, including HVAC, electric wiring, mechanical devices, utilities and plumbing. The contractor will apply for a building permit at the city. Once the city approves the building permit and the fees are paid, work can begin.

The first step in putting up the building is to break ground. Many new owners love to bring their personal shovel in to get a picture made of themselves scooping up the first pile of dirt for their new business address. After the festivities have commenced, they step aside and excavation begins.

During the excavation process, the soil is removed and/or compacted to assure a suitable base for the building foundation. Rocks, tree roots, glass, debris and the like are removed during this period.

Next, if any pipes need to be installed under the building for sewer and water, this needs to be done before the foundation is constructed. No work can be performed until this occurs. After that, construction of the foundation usually consists of pouring concrete within forms prepared by the contractor.

After the concrete foundation has cured, the initial framework can begin. During this time, the contractor will construct the exterior walls and roof. Once the building shell is completed, interior can begin. At this time, insulation, interior walls, drywall, doors, HVAC, electrical, plumbing are all completed.

Look for part three of our series to continue in a few weeks.

-Dan Hebert

The Commercial Construction Process – Part One

Let’s say you are a small business owner and are ready to take your business from a rental unit to your own brick and mortar location. Assuming you have a lot of capital and want to build in an undeveloped location, how do you get started? This is a three-part series that will walk you through the steps.

The first thing to do is to meet with a commercial real estate broker, who will work with you to select just the right spot for your desired business. You should already have an idea of the general size of the building and know how much square footage you will need in order to operate successfully.

If you are purchasing land, then once you find something suitable and enter a contract, you will go through the due diligence stage where a number of items must be checked. One of the first things to do is to have an environmental sample performed. This will check for a variety of important things such as the structural foundation of the land, any chemical or biological waste that may be present, water analysis and air pollution.

As the land is being evaluated, it’s also important to have the title company check for any liens against the property. While this is going on, you will want to check on the neighboring infrastructure. Is your new location zoned for the type of business you want to open? Are other businesses in the area doing well? Is the area growing?

Next, have the property surveyed. This will tell you whether any easements are there and show the legal boundaries that you must operate within. Are any new roads being planned by your city or state government that would cut off access to your property?

Will the location you’ve chosen give you easy access to rails or highways? Will large trucks bearing your supplies be able to get in and out for delivery? Will your customers have an easy time parking, and will you be able to develop special parking to meet the codes established by the American’s with Disabilities Act?

If you’re sure that your new location meets all of the criteria listed above and any other special city or state requirements, then it’s safe to purchase the land.

After the purchase of land, it’s time to hire an architect. This person will be responsible for the general look of your building. It’s fine to suggest building styles or ideas that you like, but remember that this person is the professional and will need to consider the overall function of the building as he or she develops the initial sketches.

A good architect will visit the proposed building site. Then, he or she will use the survey and will also be looking at land measurements in order to render the drawings. At this stage, it will just be an initial design concept. Most architects will provide a set of sketches for you to choose from. These are often referred to as schematic designs. Rough costs are mentioned during this phase.

After you work with the architect to fine tune the design (known as design development), the architect will begin developing it into blueprints. These blueprints (sometimes known as construction documents) are the tools that contractors will use as you move into the bidding process.

Look for part two of our series to continue in a few weeks.

-Dan Hebert

Why Manufacturing Growth Affects Everyone

According to studies compiled by Markit Economics, U.S. manufacturing is down for the months of August and September. The recent news of Brexit and the fact that China has reached a slump in their economy is causing slower manufacturing and spending around the world. The U.S. is only at a two percent growth rate for the year.

Minimum wage earnings are down for Americans compared with where they were about fifteen years ago, and the hiring trends by companies have also slowed. If Americans can’t spend, the economy can’t grow.

Economists have estimated that the average age that it takes to double the standard of living for the average American is now up to about seventy years. This inability to change one’s circumstances within a short amount of time has led to the baby boomers not having enough to retire on, so a lot of them go back to work. However, due to their age, they are usually stuck in dead end jobs that pay very little.

Young people who would ordinarily be graduating college, then landing that first job, buying that first home, and starting their family, are now moving back into their parents’ basements in droves. If they are lucky enough to land a great job, they are not getting great offers that the grads of twenty years ago did. In addition, the Federal Reserve is starting to increase interest rates, which makes it harder to purchase homes and automobiles.

There are several things in development here in the U.S. that are also causing our economy to be sluggish in growth. It doesn’t help that the unrest and attacks overseas have caused Americans to think twice or pause for longer periods of time before booking long awaited vacations to foreign countries. So the travel and tourism industries are suffering. In turn, those countries that might ordinarily have great products or services to export, may be suffering from a lack of workers and facilities because of war and civil unrest.

It also doesn’t help that we are all waiting on the results of the Presidential Election. The fiscal policies, public investment and structural reform that the new President will put into place will greatly affect our economy and cause ripple effects around the world.

The U.S. manufacturing companies are watching all of this unfold around them. With the advancement of the ease of deliveries, many Americans are using their purchasing power to order from overseas companies who are marketing cheap products and sometimes lesser quality to Americans who want to get the most for their dollar.

This in turn affects local suppliers who have slowed in their production times because the orders are not coming in. Many of them prefer to make items in bulk quantities, so they are hesitant to fire up the assembly lines and employ workers who many not have much to work on. The U.S. manufacturers are also hesitant to have a lot of inventory laying around, especially those who work in food services, because they know there is a shelf life to their product. They don’t want to have it still sitting in their warehouse when it’s close to expiration.

The U.S. dollar is strong right now too, and even though some countries are catering to Americans, others can’t afford to. This lessens the global demand for U.S. goods and services. However, it is estimated that nearly half of all U.S exports go to countries that we have free trade agreements with. Also, when the U.S. plants do fire up their assembly lines, it is estimated that they use about thirty percent of the nation’s energy supply in order to run their operation. So, that is good for the energy industry.

No one knows what the answer is to get the world economy moving again. Several theories have been tried and discarded. The only thing that seems to make sense is for industry leaders to invest in better training for their employees, study the competition abroad, increase funding for STEM related fields, and find ways to make great products at affordable prices.

To Own or To Sell: Commercial Real Estate Pros and Cons

Commercial real estate can be an excellent investment opportunity.

Typically, commercial properties offer more financial reward than residential properties. However in some scenarios, the risks can outnumber the rewards. Understanding the commercial real estate pros and cons is important for any investor no matter if the property was acquired by a sale or inherited. Having the ability to understand the investment and having the knowledge to make a decision if ownership or sale is the best option is crucial.

Commercial properties may refer to retail buildings, office buildings, warehouses, industrial buildings, apartment buildings and mixed use buildings. Mixed use properties feature both residential and commercial tenants in the same building.

Armed with the different types of properties available, let’s take a brief look at some of the pros and cons of owning commercial properties.

Pros

Income potential. Commercial properties generally have an annual return off the purchase price between 6% and 12%. Residential properties usually have a return averaging between 1% to 4%.

Tenant Relationship. Business owners generally take pride in their businesses and it is in their best interest to be successful and keep their business viable. A commercial property is also operated as a business, thus giving the landlord and tenant a common goal. The business-business customer relationship helps foster interactions that are professional and courteous.

Public Image. Retail tenants have a vested interest in maintaining their store and storefront, because this affects their image as well as the landlord’s. For this reason, commercial tenants and property owner interests are aligned, which helps the owner maintain the quality of the property, and ultimately, the value of their investment.

Standard Business Hours of Operation. Businesses that typically operate in a commercial setting are open during normal weekday business hours of 8am-5pm. This allows for the commercial property owner to not have late night issues or deal with tenants after hours. Typical calls are for true emergencies or a monitoring service on the building.

More objective price evaluations. Financial information is easier to acquire for commercial properties so that an evaluation of the property price is based on the current owner’s income statement. The seller should be using an experienced broker so the asking price is set where an investor can earn the area’s prevailing cap rate for the commercial property type they are looking at (retail, office, industrial, etc.).

Triple Net Leases. There are variations to triple net leases, but the general concept is that the property owner does not have to pay any expenses on the property. The lessee handles all property expenses directly, including real estate taxes. The only expense the investor handles is the mortgage payment.

More flexibility in lease terms. Fewer consumer protection laws govern commercial leases, unlike the dozens of state laws, such as security deposit limits and termination rules that cover residential real estate.

Cons

Time commitment. Owning a commercial building with numerous tenants or even just 2-3 tenants, there is more to manage than one would with a residential property investment. Ownership can’t be an absentee landlord and maximize the return on the investment. With commercial properties, there are multiple leases, annual Common Area Maintenance (CAM) adjustments, day to day maintenance issues, as well as potential safety concerns with customers and the general public accessing the property.

Property Management and Hiring Vendors. Some commercial property owners try a self-managed approach, but a more ideal situation is hiring a property management company as the best scenario for both the investor and their tenants. Licensed vendors to handle problems and issues at the building is a smart investment as well. This is an added cost which doesn’t seem ideal but these expenses can be budgeted into the building’s expenses and is well worth the cost. Property management companies can charge between 5-10% of rent revenues for their services, which include lease administration. Once a property is purchased, the investor will need to decide if they will be handling the leasing responsibilities or hiring out a broker to handle those responsibilities. If hiring a broker, be sure to budget in paying out commissions to not only the broker the investor has hired, but if potential tenants are being represented by a broker as well.

Bigger initial investment. Purchasing a commercial property typically requires more up front capital compared to a residential property. Once an investor has acquired a commercial property, they can expect some large capital expenditures to follow. Everything can be running smooth for a few months and then the roof starts leaking and now there is a $20,000 bill to address the repairs. With more customers there are more spaces to maintain and therefore more costs. For an investor, a top concern is that the increases in revenue outweigh the gains in costs, to support purchasing a commercial property.

More risks. Properties intended for commercial use have more public visitors and therefore have more people on the property each day. The more visitors that visit, the greater the chance that someone can get hurt or do something to damage the property. There are a variety of things that make commercial buildings risky such as snow removal (ice for slip and falls), vandals of all types including graffiti or damage to exteriors or landscape, and a variety of other situations. The building must have the proper insurance that can cover a potential lawsuit or building damage is very important so that there are limited responsibilities and out of pocket costs.

If looking for an investment opportunity, commercial property is a great avenue to pursue as long as one is aware of the pros and cons to make educated decisions.

Gaughan Companies Represents Seller On Medical Office Building Sale

Dan Hebert of Gaughan Companies, MN represented a physician group on the sale of their medical office building located at 8290 University Ave, Minneapolis MN. The 23,000 square foot medical property is anchored by Twin Cities Orthopedics.

“This is an institution grade asset with long term credit tenants. This coupled with low interest rates made way for a favorable CAP Rate which maximized the value for the seller.”

A solid foundation since 1969, Gaughan Companies provides the Twin Cities area with a full service real estate company. We deliver consistent performance through unparalleled professionalism and personal service. Visit our website at www.gaughancompanies.com for more information.