Minnesota Construction Industry on the Rise?

In April of 2016, Minnesota added 7,400 employment opportunities with great thanks to the development and construction industries. Statistics indicate a solid increase in development projects throughout Minnesota over the past several months. The construction industry is currently booming with this month having the largest increase in production within the past 25 years. These factors attribute to Minnesota’s lowering unemployment rate which is now approximately 3.7%, and a 1.7% increase in job growth over the past year. Specifically in the Minneapolis and St. Paul region, employment growth increased by 1.8%. These trends help to provide a positive outlook for what the future of construction may hold.

U.S. Bank Stadium Complete

Vikings fans unite in celebration of the completion of the U.S. Bank Stadium! On June 17th, 2016, Mortenson Construction was proud to announce that the stadium had been finalized six weeks prior to the scheduled completion date, and is now ready for business. The U.S. Bank Stadium boasts architectural beauty, as it was designed to reflect a modern day Vikings ship.

The grand opening ceremony is currently scheduled for July 22nd, 2016. The ceremony will be followed by a weekend long festival that will include fun festivities for the whole family!

We are proud to recognize this achievement as a historic milestone in the Twin Cities.

Stealth Train – A reality or fantasy?

In 2014, the North American High Speed Rail (NAHSR) had proposed a business plan for the privately funded 200 MPH Stealth Train, which would be built to expedite travel from the Twin Cities metro area to Rochester. The High Speed Rail (HSR) route is a proposed 77 mile track that is estimated to make the commute in 45 minutes.

The HSR will be fueled by clean electricity supplied by renewable sources such as wind, solar, geothermal, and ocean power. The HSR project is estimated to create more than 4,000 construction jobs, and will help alleviate the congestion on highways and runways. This would positively impact society by decreasing the amount of traffic fatalities caused along this route. This project would also boost economic activity due to a variety of factors that are estimated at $1.6 billion dollars per year.

Current theories on the actuality of the HSR coming to life in MN are met by opposition due to rural land owners in Minnesota, and conflicts of interest expressed by concerned MN citizens. There is also concern over the speculation that the train would be outsourced to China for their rail expertise, however no official statement has been released regarding this theory.

The statement from MN Transportation Commissioner, Charles Zelle, was optimistic as he commented, “The Governor’s observation is this will happen in someone’s lifetime in North America, why not here?”

The development of HSR should be an interesting topic as MN learns more about this project coming to life over the next two years.

Read more on the HSR at, (TCB) Twin Cities Business www.tcbmag.com

To Own or To Sell: Commercial Real Estate Pros and Cons

Commercial real estate can be an excellent investment opportunity.

Typically, commercial properties offer more financial reward than residential properties. However in some scenarios, the risks can outnumber the rewards. Understanding the commercial real estate pros and cons is important for any investor no matter if the property was acquired by a sale or inherited. Having the ability to understand the investment and having the knowledge to make a decision if ownership or sale is the best option is crucial.

Commercial properties may refer to retail buildings, office buildings, warehouses, industrial buildings, apartment buildings and mixed use buildings. Mixed use properties feature both residential and commercial tenants in the same building.

Armed with the different types of properties available, let’s take a brief look at some of the pros and cons of owning commercial properties.

Pros

Income potential. Commercial properties generally have an annual return off the purchase price between 6% and 12%. Residential properties usually have a return averaging between 1% to 4%.

Tenant Relationship. Business owners generally take pride in their businesses and it is in their best interest to be successful and keep their business viable. A commercial property is also operated as a business, thus giving the landlord and tenant a common goal. The business-business customer relationship helps foster interactions that are professional and courteous.

Public Image. Retail tenants have a vested interest in maintaining their store and storefront, because this affects their image as well as the landlord’s. For this reason, commercial tenants and property owner interests are aligned, which helps the owner maintain the quality of the property, and ultimately, the value of their investment.

Standard Business Hours of Operation. Businesses that typically operate in a commercial setting are open during normal weekday business hours of 8am-5pm. This allows for the commercial property owner to not have late night issues or deal with tenants after hours. Typical calls are for true emergencies or a monitoring service on the building.

More objective price evaluations. Financial information is easier to acquire for commercial properties so that an evaluation of the property price is based on the current owner’s income statement. The seller should be using an experienced broker so the asking price is set where an investor can earn the area’s prevailing cap rate for the commercial property type they are looking at (retail, office, industrial, etc.).

Triple Net Leases. There are variations to triple net leases, but the general concept is that the property owner does not have to pay any expenses on the property. The lessee handles all property expenses directly, including real estate taxes. The only expense the investor handles is the mortgage payment.

More flexibility in lease terms. Fewer consumer protection laws govern commercial leases, unlike the dozens of state laws, such as security deposit limits and termination rules that cover residential real estate.

Cons

Time commitment. Owning a commercial building with numerous tenants or even just 2-3 tenants, there is more to manage than one would with a residential property investment. Ownership can’t be an absentee landlord and maximize the return on the investment. With commercial properties, there are multiple leases, annual Common Area Maintenance (CAM) adjustments, day to day maintenance issues, as well as potential safety concerns with customers and the general public accessing the property.

Property Management and Hiring Vendors. Some commercial property owners try a self-managed approach, but a more ideal situation is hiring a property management company as the best scenario for both the investor and their tenants. Licensed vendors to handle problems and issues at the building is a smart investment as well. This is an added cost which doesn’t seem ideal but these expenses can be budgeted into the building’s expenses and is well worth the cost. Property management companies can charge between 5-10% of rent revenues for their services, which include lease administration. Once a property is purchased, the investor will need to decide if they will be handling the leasing responsibilities or hiring out a broker to handle those responsibilities. If hiring a broker, be sure to budget in paying out commissions to not only the broker the investor has hired, but if potential tenants are being represented by a broker as well.

Bigger initial investment. Purchasing a commercial property typically requires more up front capital compared to a residential property. Once an investor has acquired a commercial property, they can expect some large capital expenditures to follow. Everything can be running smooth for a few months and then the roof starts leaking and now there is a $20,000 bill to address the repairs. With more customers there are more spaces to maintain and therefore more costs. For an investor, a top concern is that the increases in revenue outweigh the gains in costs, to support purchasing a commercial property.

More risks. Properties intended for commercial use have more public visitors and therefore have more people on the property each day. The more visitors that visit, the greater the chance that someone can get hurt or do something to damage the property. There are a variety of things that make commercial buildings risky such as snow removal (ice for slip and falls), vandals of all types including graffiti or damage to exteriors or landscape, and a variety of other situations. The building must have the proper insurance that can cover a potential lawsuit or building damage is very important so that there are limited responsibilities and out of pocket costs.

If looking for an investment opportunity, commercial property is a great avenue to pursue as long as one is aware of the pros and cons to make educated decisions.

John Chirhart Moderates Annual Land Development Conference

On Friday May 6, 2016 The Minnesota Real Estate Journal held their 12th Annual Land Development Conference at the Golden Valley Country Club. Gaughan Companies’ John Chirhart was moderator for the Opportunities for Commercial Land Development section with a panel that included Brian Pankratz with CBRE, Tony Barranco from Ryan Companies, and Phil Cattanach of The Opus Group. Topics they covered in their discussion included:

- New Opportunities for development is happening in urban core right now

- What types of projects are in consideration for land development

- What are the challenges with land development vs. redevelopment

- Who is active in the market place and what is their risk tolerance and expected returns

- When or will there be a next big wave of land development or is it a thing of the past

Attendees were treated to a wide variety of topics moderated by industry professionals. Other topics in the Land Development Conference included Land Plan Optimization, “Hot” Legal Topics in Land Development, How to Effectively Work With Municipalities, and the Residential Home Builders Roundtable.

John Chirhart started his career in commercial real estate back in 2000 and has been with Gaughan Companies since 2009. During his time with Gaughan Companies, John has been involved in numerous land transactions including recently helping a client sell 157 acres in Lino Lakes to home builder Lennar. John, along with his business partner Lou Suski, have sold hundreds of acres of land in the past couple years and are currently listings hundreds of acres more for current clients throughout the metro and rural areas. If you own any land that you are interested in selling contact the Gaughan Companies Brokerage Department today at 651-464-5700 or contact them HERE.

There’s Magic in a Mission

When my leadership team and I were determining our Mission Statement, it was important to us that we not only convey what we do, but that we care about our clients.

Our Mission Statement is simple but not simplistic:

“We care for people’s real estate interests through Construction, Brokerage, Development, Management and Maintenance.”

Real estate is where life happens, where business is conducted or a family resides. We do not just care for the real estate, we care for the real people who occupy those places.

Our Mission Statement not only says what we do, but it keeps our team laser focused on our purpose and commitment to our clients, which is where the magic really happens!

In the article below my good friend and business colleague Chris Naylor talks about the importance of having a Mission Statement in her blog ‘There’s Magic in a Mission!’ I am confident that if you have not already found your mission this article will give you direction on where to start!

Patrick Gaughan

Gaughan Construction Completes Phase One at City Center Commons

Gaughan Construction’s City Center Commons project has reached a milestone with the completion of building one. Located along Highway 61 on the south end of town, this gorgeous building features a classy brick exterior as well as Silverdale Kansas limestone compliments. The development, paired with the new Forest Lake City Center, brings life to the site that was once home to the former Northland Mall.

The 11,000 SF building is the new home for Forest Lake businesses Thrifty White Pharmacy and Maplewood Oral and Maxillofacial Surgery. The new location puts Thrifty White Pharmacy’s new condensed store model on display as well as providing a drive-thru option for customer convenience. Maplewood Oral was able to increase the square footage of their business by more than double from the company’s previous Forest Lake location.

Stay tuned for updates as the City Center Commons project commences with the completion of building two. The 8,000 SF building will be the new home of Keller Williams and is slated to be completed early Summer 2016.

Do Good For Your Community

Patrick Gaughan of the Gaughan Companies recently sat down and talked with the Real Estate Journal and discussed his reasons for success in the competitive world of commercial real estate. On why community and keeping the best people around him has been part of his successes:

“So much of my success has been because I’m able to keep my clients with me year after year. I do try to spend a lot of time with them, a lot of time trying to understand their needs and goals. Every year, we host a fishing trip for our clients. We all go out and catch some salmon. That’s fun. But the key is to help your clients do more business. That is what they are all looking for. Say we have a tenant who needs SBA financing for a business. We will refer that client to a banker that we know will do a good job. That banker then refers us business. It’s about being useful to your clients.”

Click here to read the full article from the Real Estate Journal!

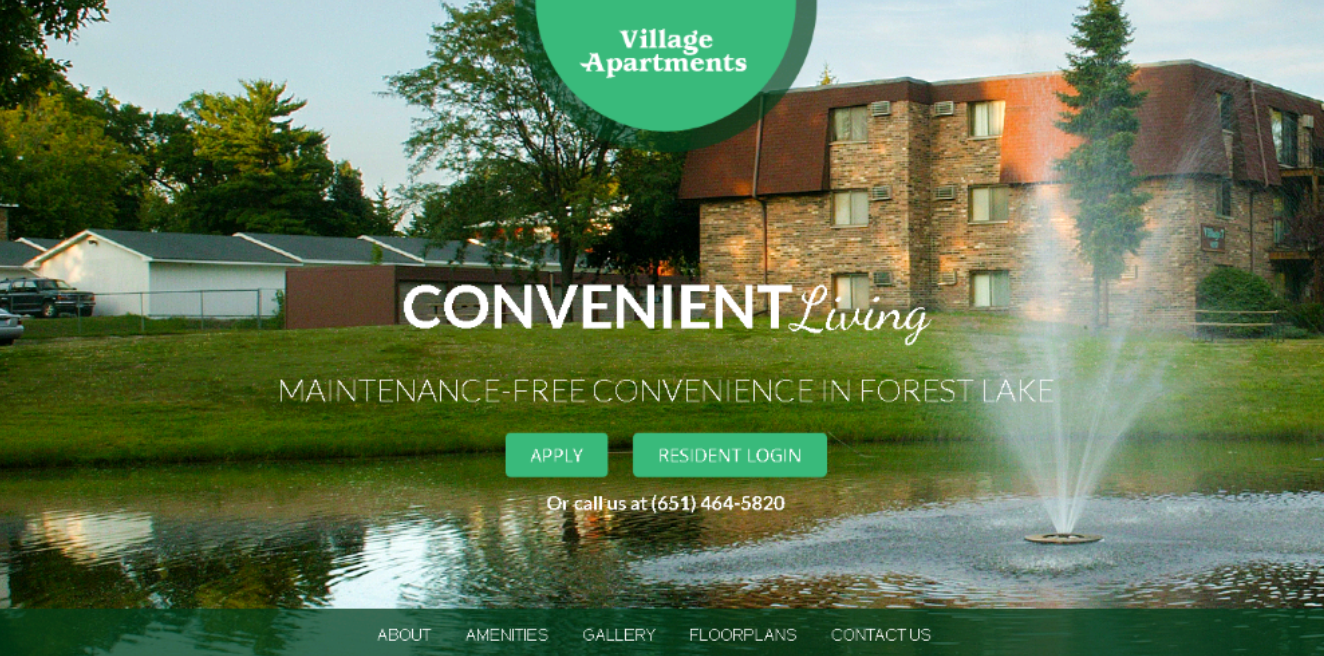

Village Apartments in Forest Lake Introduces Its New Website

The Village Apartments in Forest Lake, Minnesota is pleased to announce the completion of its brand new website. The website brings a modern feel along with an easy to navigate format. Potential residents will be able view floor plans, look at interior photos of units as well as have the ability fill out and submit their applications directly from the website. If you are a current resident of the Village Apartments, the resident login portal is front as center as you land on the page, making it convenient to access your online account.

The Village Apartments website can be found at:

City Center Commons Construction Update

Ground broke on Gaughan Construction’s City Center Commons project in mid-August. It is the first ground up construction project for the company in almost a decade. In the past few weeks, significant progress has been made on the exteriors of both buildings.

The buildings will serve as new locations for local businesses Keller Williams, Thrifty White, and Maplewood Oral and Maxillofacial Surgery here in Forest Lake. Along with the recently built Forest Lake City Center, the City Center Commons project will provide a fresh, updated look to the south end of town along Highway 61. The new locations should be open for business in early 2016.

Below are several of aerial pictures of the ground up construction we would like to share.